Gold Bullions

The golden standard.

A timeless asset, built for the future.

Gold has always held a unique place in the world of wealth. Revered across empires and economies, it represents stability, value, and power.

At Golden Dram, we offer access to gold bullions, real, tangible assets for those who see the long game and move with clarity.

The History

Gold’s story stretches back over 5,000 years. From the riverbeds of Mesopotamia to the tombs of ancient Egypt, it was valued not just for its beauty, but for its permanence. Egyptians saw it as the “flesh of the gods,” while Greeks and Romans minted it into currency that fuelled early trade and empire.

By 600 BC, gold coins were being used as currency by the Lydians, establishing gold’s role as both medium of exchange and symbol of prestige. Fast forward to the 19th century, and gold became the backbone of economic systems through the Gold Standard—linking national currencies to gold reserves and reinforcing trust in value.

Type of Bullions

Gold bullion comes in two main forms: bars and coins. Both are valued for their purity, weight, and liquidity. At Golden Dram, we focus on premium gold bullion coins, recognised globally, easy to store, and simple to trade.

These coins are typically minted in weights such as 1oz and are struck with designs that enhance both their recognition and collectability.

Why gold bullions?

A timeless asset. Built for resilience.

Gold has held its place through centuries of change. As a hedge, a haven, and a symbol of lasting value, it continues to be a cornerstone in forward-looking portfolios. Gold bullions offer both security and liquidity in one trusted form.

Hedge Against Inflation

Gold maintains value even as currencies lose theirs. It’s a proven hedge during periods of economic instability and inflation.

Portfolio Diversification

Gold tends to move independently from traditional markets, offering balance and risk mitigation in a broader financial strategy.

Safe Haven Status

In times of crisis—political, financial or otherwise—gold becomes a go-to asset, trusted for its history, tangibility, and reliability.

Global Demand, Limited Supply

Gold remains in high demand across industries, while mining output remains constrained. Scarcity supports long-term value.

Highly Liquid

Recognised and traded globally, gold bullions are among the most liquid assets you can own.

Physical Ownership

Gold is real. Not digital, not speculative. It’s tangible wealth you can hold and store securely, without reliance on third-party systems.

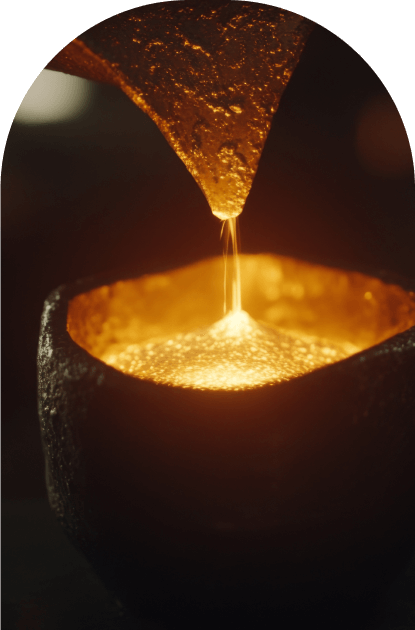

The golden story

Built on craft. Forged by experience.

Like liquid gold, every step is shaped by care, precision, and time. With decades of expertise, we make owning rare assets seamless from the start.

Step 2

Buy with ease

Purchase online or book a consult for guided support.

Step 3

Transfer of ownership

The asset becomes yours – clear, direct, complete.

Step 4

Ready to exit?

We will support you with advice where possible.

What is next?

A strategic asset, now in your hands

Gold is more than a store of value, it’s a signal of intent.

Whether you’re buying for stability, legacy or diversification, Golden Dram helps you acquire, hold and benefit from physical gold in a way that’s simple, secure and tailored to you.

Start building your position in one of the world’s most trusted assets.